As someone who spent years in the Big Four and holds a BSc (Hons) in Economics alongside a CIMA CGMA Dip MA designation, I’ve always approached finance with a blend of discipline and curiosity. The market volatility in April 2025 gave me the perfect opportunity to seriously start and document my personal investment journey as a practitioner testing theory against reality with my own capital at stake. I’ll continue sharing updates, not as advice, but as a real-time case study in disciplined, conviction-driven investing.

My goal is to grow wealth rapidly, yet responsibly. This means balancing fundamentals, technical signals, and deep dives into financial statements, not to chase every headline winner, but to identify mispriced growth. I accept that this approach will cause me to miss some spectacular runs. That’s by design. I’m not seeking lottery tickets; I’m building a portfolio weighted toward opportunities where the probability of sustained value creation aligns with my growth targets.

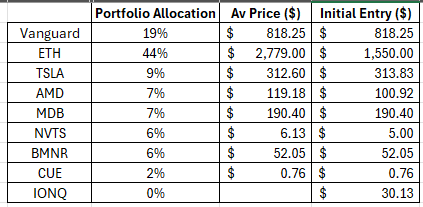

Here’s how the portfolio took shape at inception (April 2025), constrained by personal liquidity but guided by conviction:

~20% in a low-cost S&P 500 index fund: My anchor. A store of value and benchmark against which I can measure active decisions.

Ethereum (ETH): Acquired near multi-year lows. Having witnessed real-world enterprise and DeFi innovation built on its rails during my consulting days, I see ETH not just as crypto, but as infrastructure. Target: $1,800–$2,500 by year-end; with a long-term bull case well into four figures.

AMD: A household name trading near historic lows, yet deeply embedded in the AI narrative. Its open-source ethos and roadmap suggest strong recovery potential in 206-2027. It’s recovery from the lows of ~$80 presented a good opportunity to buy. Target: $150 by EOY 2025; $300+ in a breakout scenario.

Tesla (TSLA): At $300, the market seems to ignore the imminent monetisation of Full Self-Driving, Optimus robotics, and potential synergies with xAI. Don’t bet against Elon’s track record of delivering against his ambitious targets. Target: $440 by year-end; $600+ if execution accelerates.

MongoDB (MDB): Trading at $190 is a stark anomaly for a category leader in NoSQL databases with a strong and seasoned management team, which have largely go unchanged. Historically valued between $300–$600, this feels like a temporary misread.

Navitas (NVTS): A strategic satellite play, supplying semiconductors to NVIDIA and Dell. Target: $12 by EOY; $100 in a semiconductor supercycle.

Bitminer (BMNR): An indirect, capital-efficient way to gain ETH exposure without raising my average ETH buying price, and backing Tomy Lee’s vision. High-conviction long-term hold.

Cue Biopharma (CUE): My calculated “moonshot.” After its post-IPO crash, the company has right-sized, and is continuing to extend it’s runway through it’s clinical trial progress unlocking new payment milestones and partnerships. The small initial invest caps the downside risk, and if it goes right, the growth could be exponential.

Note, I exited IonQ (IONQ) during the year at $41.20 (entry: $30.13) after reassessing its revenue trajectory versus valuation and the feasibility of the announced roadmap. The gains were rotated into BMNR as this portfolio prioritises medium to long term stability over highly speculative gains.